Smarter Ways to Keep Real Estate in the Family for Now or Forever

5 out of 5

| Language | : | English |

| File size | : | 4361 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 48 pages |

Real estate is often a family's most valuable asset. It can be a source of income, a place to live, and a legacy to pass on to future generations. But keeping real estate in the family can be challenging. There are estate taxes, property taxes, and other costs that can eat away at its value. And if the property is not properly managed, it can be lost to creditors or other claimants.

There are a number of smarter ways to keep real estate in the family. By planning ahead and using the right legal structures, you can protect your property and ensure that it remains in your family for generations to come.

1. Create a Living Trust

A living trust is a legal document that allows you to transfer your assets to a trustee, who will manage them according to your instructions. Living trusts can be used to avoid probate, which is the court process of administering an estate after someone dies. Probate can be time-consuming and expensive, and it can also expose your estate to public scrutiny.

By creating a living trust, you can keep your real estate out of probate and ensure that it is distributed to your beneficiaries according to your wishes.

2. Use Joint Ownership

Joint ownership is another way to keep real estate in the family. When you own property jointly with someone else, both of you have an equal interest in the property. This means that if one of you dies, the other person will automatically inherit your share of the property.

Joint ownership can be a simple and effective way to keep real estate in the family. However, it is important to note that joint ownership can also have some drawbacks. For example, if one of the joint owners gets into financial trouble, the other owner's interest in the property could be at risk.

3. Form a Limited Liability Company (LLC)

An LLC is a type of business entity that can be used to hold real estate. LLCs offer a number of advantages, including limited liability protection and tax benefits. Limited liability protection means that the owners of an LLC are not personally liable for the debts and liabilities of the LLC. This can protect their personal assets from creditors.

LLCs can also be used to reduce taxes. LLCs are taxed as pass-through entities, which means that the profits of the LLC are passed through to the owners and taxed on their individual tax returns. This can result in significant tax savings.

4. Establish a Land Trust

A land trust is a type of trust that is used to hold real estate. Land trusts are often used to protect land from development or to preserve it for future generations. Land trusts can also be used to reduce taxes.

When you establish a land trust, you transfer your ownership interest in the property to the land trust. The land trust then becomes the legal owner of the property. However, you retain the right to use and enjoy the property as you wish.

Land trusts can be a good way to keep real estate in the family while also ensuring that it is used for its intended purpose.

5. Create a Family Limited Partnership (FLP)

A FLP is a type of partnership that is used to hold real estate. FLPs offer a number of advantages, including limited liability protection and estate tax benefits. Limited liability protection means that the partners of an FLP are not personally liable for the debts and liabilities of the FLP. This can protect their personal assets from creditors.

FLPs can also be used to reduce estate taxes. FLPs are taxed as pass-through entities, which means that the profits of the FLP are passed through to the partners and taxed on their individual tax returns. This can result in significant estate tax savings.

6. Use a Generation-Skipping Transfer Tax (GST) Exemption

The GST tax is a tax that is imposed on gifts and inheritances that are made to grandchildren or other generations that skip a generation. The GST tax can be a significant burden, but there is an exemption that can be used to reduce or eliminate it.

The GST exemption is a per-person exemption. This means that each person can give or inherit a certain amount of money or property to their grandchildren or other generations that skip a generation without having to pay the GST tax.

The GST exemption can be a valuable tool for keeping real estate in the family. By using the GST exemption, you can reduce or eliminate the taxes that would be imposed on gifts or inheritances that are made to your grandchildren or other generations that skip a generation.

7. Plan for Estate Taxes

Estate taxes are taxes that are imposed on the value of an estate after someone dies. Estate taxes can be a significant burden, and they can eat away at the value of your real estate. There are a number of things that you can do to plan for estate taxes, including:

- Making gifts to your heirs during your lifetime

- Using trusts to reduce the value of your estate

- Purchasing life insurance to pay for estate taxes

By planning for estate taxes, you can protect your real estate from being taxed at a high rate and ensure that it is passed on to your heirs in the most advantageous way possible.

8. Plan for Property Taxes

Property taxes are taxes that are imposed on the value of real estate. Property taxes can be a significant

5 out of 5

| Language | : | English |

| File size | : | 4361 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 48 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Wijnand Jongen

Wijnand Jongen Susan Straight

Susan Straight Beth Taylor

Beth Taylor Steven Bruce

Steven Bruce Jessica Roux

Jessica Roux Mark Rippetoe

Mark Rippetoe Anne Hillerman

Anne Hillerman Ken Hunt

Ken Hunt Deborah Middleton

Deborah Middleton Duane Lindsay

Duane Lindsay Patricia Gaydos

Patricia Gaydos Anne Applebaum

Anne Applebaum J Krishnamurti

J Krishnamurti Anne Mccaffrey

Anne Mccaffrey Emma Mak

Emma Mak John Seymour

John Seymour Rachel Medhurst

Rachel Medhurst Frederick Law Olmsted

Frederick Law Olmsted Sam Wilkin

Sam Wilkin India T Norfleet

India T Norfleet

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Colin RichardsonA Journey Through Time: Exploring the Late Intermediate Piano Suite Recital...

Colin RichardsonA Journey Through Time: Exploring the Late Intermediate Piano Suite Recital... Nathan ReedFollow ·15.8k

Nathan ReedFollow ·15.8k Jerry HayesFollow ·9.8k

Jerry HayesFollow ·9.8k Chandler WardFollow ·2.8k

Chandler WardFollow ·2.8k Vic ParkerFollow ·12.6k

Vic ParkerFollow ·12.6k Felix HayesFollow ·2.2k

Felix HayesFollow ·2.2k Devin RossFollow ·16.2k

Devin RossFollow ·16.2k Charlie ScottFollow ·2.7k

Charlie ScottFollow ·2.7k Chadwick PowellFollow ·12.1k

Chadwick PowellFollow ·12.1k

Jared Nelson

Jared NelsonThe Da Vinci Code: A Literary Odyssey into the World of...

A captivating image of The Da Vinci Code...

Harvey Bell

Harvey BellJohn Pearce: An Action-Packed Maritime Adventure

Join John...

Ken Follett

Ken FollettSky Dragons: Unveiling the Majestic Creatures from the...

In the ethereal world of Anne McCaffrey's...

Blake Bell

Blake BellEasy And Delicious Baking Recipes You Can Effortlessly...

Baking can be a great way to relax and...

Maurice Parker

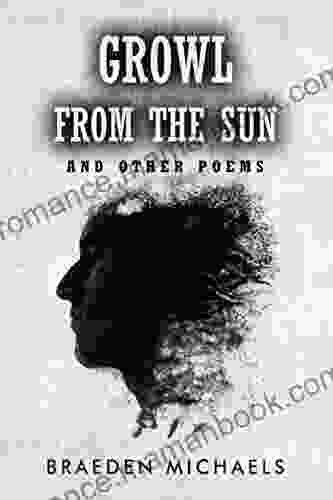

Maurice ParkerUnveiling the Profound Insights and Lyrical Beauty of...

In the realm of contemporary poetry, "Growl...

5 out of 5

| Language | : | English |

| File size | : | 4361 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 48 pages |